Introduction

As digital assets reshape global finance, Islamic scholars and fintech innovators are tasked with navigating this space through the lens of Shariah. While conventional taxonomies group tokens by technology or economics, Islamic finance requires a distinct framework—rooted in classical Fiqh principles.

At Azka Advisors, we’ve developed a Shariah-centric taxonomy of crypto assets to help scholars, platforms, and investors ethically engage with the digital asset ecosystem.

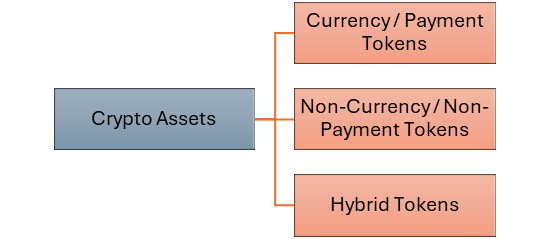

Level 1: Primary Shariah Classification

1. Currency/Payment Tokens

Coins/tokens in this category function as digital money or medium of exchange. They are governed by currency exchange (Bai‘ al-Sarf) Shariah rules, which emphasize immediate exchange and Riba avoidance. Example: Bitcoin (BTC)

2. Non-Currency/Payment Tokens

These coins/tokens represent non-monetary rights, utility, or real-world assets. They are evaluated according to the Shariah principles specific to the underlying asset or source of value. Example: UniSwap token (UNI)

3. Hybrid Tokens

These tokens have dual functionality—used both as a mode of payment and also have a utility, right, usufruct, or real-world asset behind them. Example: Ether (ETH)

Classification Criteria:

- If monetary use dominates → classify as currency.

- If non-currency feature dominates → treat as non-currency.

- If unclear → apply stricter currency rules.

Level 2: Functional Subcategories

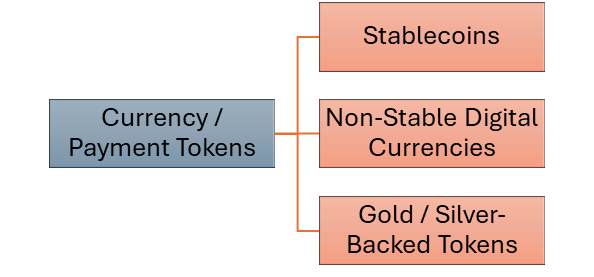

Currency/Payment Tokens

Currency or payment coins/tokens can be further divided into other categories, such as:

1.1 Stablecoins

A stablecoin is a cryptocurrency whose value is pegged to another fiat currency. The peg is maintained through various means, like cash reserves, crypto collaterals, or algorithms. Examples: USDC, USDT, FRAX, CBDCs

Shariah Focus: Reserve backing, redemption model, and exposure to interest.

1.2 Non-Stable Digital Currencies

They are designed primarily as peer-to-peer digital currencies. Examples: BTC, LTC, XRP

Shariah Focus: Payment use, Sarf rules.

1.3 Gold/Silver-Backed Tokens

Gold and silver are recognized under Shariah or Islamic Fiqh as natural currencies (Thaman Khulqi), therefore, direct tokenized representation of physical gold and silver is considered currency in Shariah. Examples: PAXG, XAUT

Shariah Focus: Considered Naqd (natural currency), must be redeemable, ownership and possession must be clear.

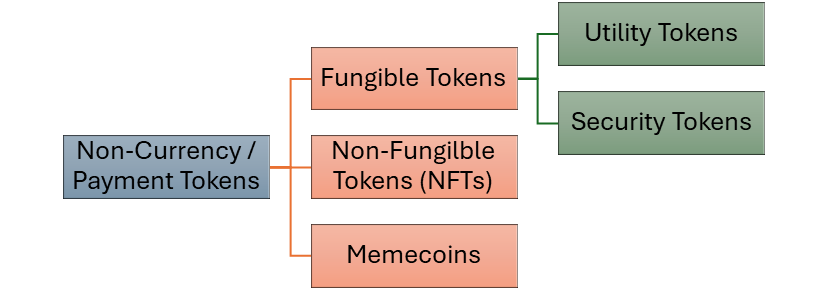

Non-Currency/Payment Tokens

Non-currency or payment coins/tokens can be further divided into other categories, such as:

2.1 Fungible Tokens

- Utility Tokens (e.g., UNI, LINK)

They represent a utility or benefit in the form of access to a platform, application, or network feature.

Shariah Focus: Type of benefits, rights granted, Gharar avoidance. - Security Tokens

They represent ownership in financial instruments or real-world assets. They are mainly considered as securities because of their investment aspect. They are further divided into: -

- Asset-backed (e.g., real estate, equities, commodities, excluding gold, silver, and fiat).

- Synthetic assets (e.g., mirror real-world assets like stocks, indexes via derivatives, such as, sTSLA).

Shariah Focus: Asset permissibility, ownership clarity, speculative elements.

2.2 Non-Fungible Tokens (NFTs)

They are unique digital tokens that represent ownership or rights over digital or real assets. Examples: collectibles, digital art, real estate deeds, IP rights, etc.

Shariah Focus: Tangibility of benefit, lawful transfer, speculative risk.

2.3 Meme Coins

They are tokens with minimal or no utility, often driven by community hype or humor. Examples: DOGE, SHIB, PEPE

Shariah Focus: High Gharar and Maysir exposure, case-by-case review advised.

Functional Notes

- A token may serve multiple purposes, but classification here is based on its dominant intended use, not incidental roles.

- Categorization is not a Shariah verdict. It is an analytical framework. Permissibility depends on:

- Underlying asset/benefit/utility/other source of value

- Contractual structure

- Risk transfer and ownership

- Compliance with key principles (Riba, Gharar, Maysir, etc.)

Conclusion

A Shariah-based taxonomy is a foundational step toward ethical innovation in halal crypto space. It bridges tradition and technology, enabling confident navigation of Web3 for both scholars and Muslim investors.

At Azka Advisors, we’re committed to developing such frameworks, screening tools, and certifications—so that the future of crypto finance and Web3 remains halal, ethical, and impactful.